In the absence of clearly established accounting rules under the United Nations Framework Convention on Climate Change (UNFCCC), each developed country has been able to decide what it reports as ‘climate finance’3. In November 2020, the Organisation for Economic Co-operation and Development (OECD), a club of mostly rich countries, released a report stating that climate finance reached US$78.9 billion in 2018 (ref. 4). But there is widespread scepticism about these numbers. Previous OECD reports have been poorly received or simply rejected by developing country representatives, charities and academic observers3. The OECD itself acknowledges that “significant inconsistencies in terms of methodologies, categorizations and definitions adopted across countries” exist in developed countries’ official reporting to the UNFCCC4. The resulting multitude of accounting approaches has led to widely contrasting reports on total public climate finance that has been provided annually (Table 1). Statements on private climate finance mobilized by developed countries in poor countries are even more contested.

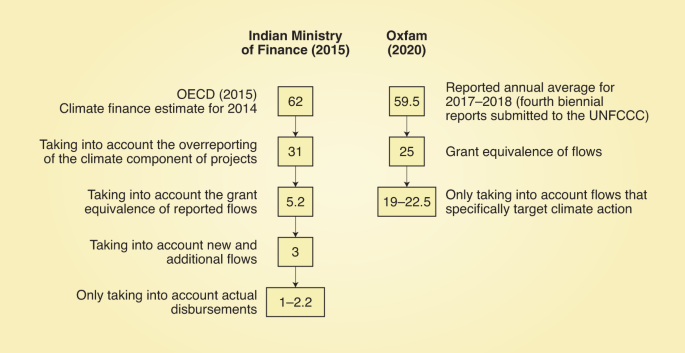

Views on OECD and UNFCCC collations of claims by developed nations have conflicted glaringly. For example, in 2013–2014, the OECD claimed an annual average of US$57 billion of total public and private climate finance, while the Indian Ministry of Finance pointed to loopholes in their methodology and asserted that only US$1–2.2 billion should be counted5. In contrast to the recent OECD 2020 report, Oxfam estimated only US$19–22.5 billion in public finance specifically targeting climate action from 2017–2018, a third of what was reported by developed countries6.

The huge differences in numbers are mostly linked to three issues (Fig. 1). First, most developed countries count all financial instruments (loans, grants, investments, insurance) at face value in their reporting to the UNFCCC7,8. This means that a US$50 million loan appears equal to a grant of US$50 million in spite of the fact that US$60 million or more might have to be repaid on even ‘concessional loans’ (that is, loans that are extended on terms more generous than market loans), and such repayments would not be counted against the original flows5,6.

Values indicate billions of total US$ estimated to be actually flowing from developed nations to developing nations.

Second, bilateral and multilateral funding flows have been screened by completely different methods for whether they target climate objectives and should therefore count towards the annual US$100 billion per year pledge. The OECD Rio Marker system, where governments self-categorize their projects as either ‘principally’ or ‘significantly’ climate-related9, was especially problematic. These Rio Markers for climate change mitigation and adaptation have been refined over the years but were often unevenly applied by donors9. Each member nation continues to use a different factor by which they scale the amount of a project they count if a project just lists climate as one aim, versus being its principal objective — these vary from 0% all the way to 100%3,9. Meanwhile, multilateral development banks developed their own categorization system10, and accounting methodologies used by some countries have changed over time, complicating any assessment of trends.

Third, the long-standing issue of whether funds are ‘new and additional’, as has been promised since 1992, has not been resolved. The diversion of development assistance, which was previously used for education and health to areas that count as climate finance, for example, would be funding reallocated rather than increased. Substantial controversies persist on the issue.

More Stories

Wix Evaluate 2020

Make All Your Insurance Straightforward

Purchase Excessive Quality Backlinks