Denver divorce legal professional Brenda Storey is battling to preserve her regulation license. (Photo courtesy of Fb)

The Colorado Supreme Court will choose in the coming months regardless of whether a Denver divorce lawyer should reduce her law license for one particular yr soon after she badgered a broke shopper to spend her, covertly banked a couple’s tax refund check and dismissed a judge’s buy.

In June 2021, a three-member point out disciplinary board decided that Brenda Storey must drop the law license she has had considering that 1995 for one calendar year and 1 working day. Storey appealed that determination to the Supreme Courtroom, which heard oral arguments last month.

The situation, initially lined by Colorado Politics, facilities close to the divorce of Cynthia Sullivan from her husband, Patrick Caldwell Sullivan, amongst 2018 and 2020. Storey represented Sullivan, the wife. The couple experienced $3.3 million in assets to break up but because Caldwell Sullivan, a genuine estate agent, was the sole earner, Sullivan was broke by mid-2019.

“You will owe me $40,000 by July 20th, and if it is not paid out by someone, I am withdrawing,” Storey wrote to her client on July 2, 2019. She told Sullivan to market the couple’s home furnishings and anything else she could. “I do not want to go away you, you will need me and my type.”

Sullivan later on testified that she was “completely in shock” at Storey’s actions, considering the fact that her lawyer understood she was “really hurting for money.” Sullivan felt “threatened” by the requires.

“You do not have a selection as to whether or not you pay back me in full. To me, my invoice is the best priority around your sprinkler invoice, faculty materials, or in any other case,” Storey wrote in a different email.

Then, one particular working day in late July 2019, a examine arrived at Sullivan’s doorway. “I am awestruck with the timing of this,” she wrote to Storey, who responded, “I am a significant believer that God winks.”

It was an IRS refund check for $47,578. There was only 1 challenge: It was penned to each Sullivan and her spouse. In accordance to the disciplinary board, Storey did not mind.

“You are not talking with him about this stuff, are you?” the attorney emailed Sullivan on Aug. 6, 2019, referring to the husband. “There is no motive for him to locate out about the tax refund just still.” Sullivan pressured that she had not instructed Caldwell Sullivan about the look at, which Sullivan experienced signed above to Storey’s legislation company previously that 7 days.

Storey then threatened to withdraw from the circumstance yet again if Sullivan could not fork out the $5,250 she nevertheless owed. In an e mail demanding payment, Storey claimed that if she wasn’t paid, she would have to file financial files which would display Sullivan had produced a huge one-time payment and Sullivan’s husband “will be pushing you about from where by that dollars arrived.” Sullivan later on testified that she go through the e-mail as a “direct threat” to expose her.

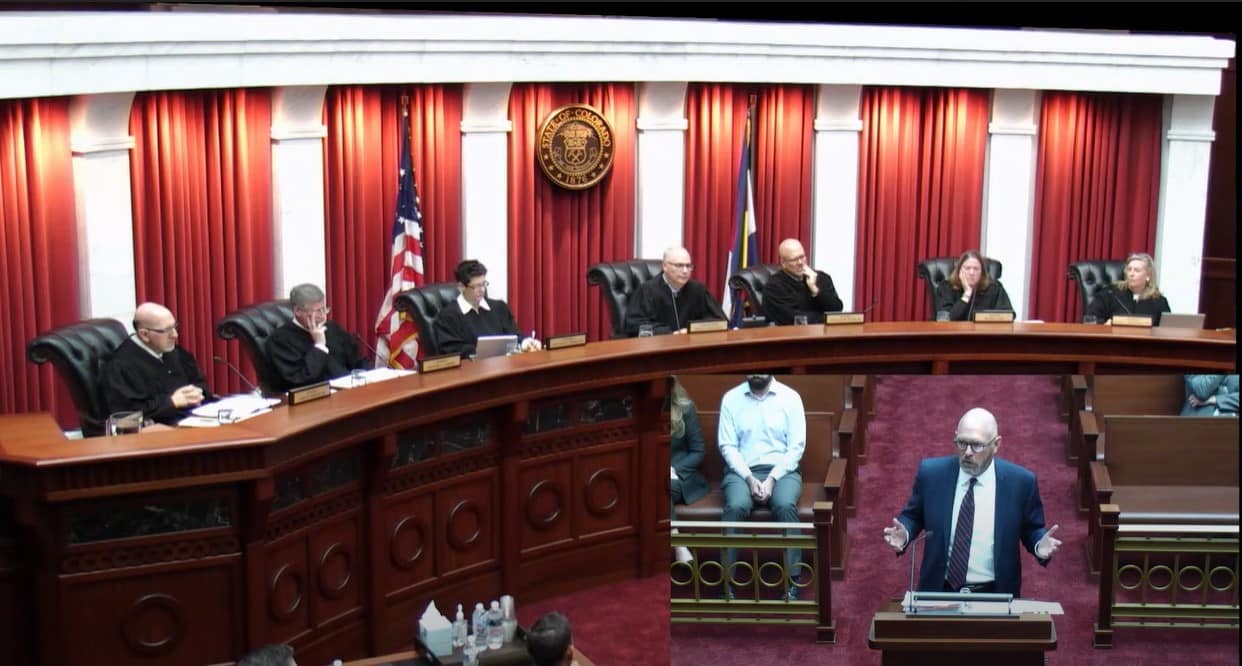

Michael McConnell, base proper, speaks right before the Colorado Supreme Court docket on June 21. (Screenshot)

Storey withdrew from the circumstance in September 2019 and talked about the IRS examine to Sullivan’s new legal professional, who was so concerned that she referred to as the Colorado Bar Association’s ethics hotline for guidance. That attorney, Jennifer Alldredge, then alerted Caldwell Sullivan’s legal professional and an Arapahoe County choose ordered Storey to return the funds.

“Cynthia Sullivan has under no circumstances ever paid out Brenda Storey,” the latter claimed at an October 2019 hearing, referring to herself in the third particular person. “She’s never ever paid me a penny.”

The adhering to January, Storey was once again purchased by a choose to hand in excess of the revenue but did not do so until March of 2020, in accordance to the disciplinary board’s final decision past year.

In a comprehensive 35-page ruling, the board decided Storey place her own fascination ahead of her clientele when she “aggressively pushed Ms. Sullivan to liquidate marital assets” that she wrongly cashed the IRS check out, which was a marital asset, and hid its existence from the partner and that she violated the judge’s September 2019 purchase to turn about the dollars.

Storey, who experienced hardly ever been disciplined all through a 25-year vocation in advance of the Sullivan case, appealed the board’s ruling and proposed punishment to the state’s greatest court docket.

“There is a usually accepted practice in the loved ones law bar that marital belongings can be employed to pay out lawful service fees although a divorce situation is proceeding,” Storey’s attorney, Michael McConnell, advised the Supreme Courtroom on June 21, 2021. “Ms. Storey believed when she approved the money from the IRS refund, that she was next this frequently acknowledged apply.”

Justin Moore, an attorney with the state’s Place of work of Attorney Regulation Counsel, disputed that: “Ms. Storey did not have interaction in a generally accepted apply. Her argument attempts to make a generally accepted follow fit her individual dishonest, egocentric perform.”

Justice William Hood seemed skeptical of Moore’s assert that Storey’s forceful e-mails amounted to a violation of the policies of professional perform for lawyers.

“We may well glance at snippets and say, ‘That appears reprehensible’ or, ‘That looks much too belligerent,’” Hood informed Moore, “but it feels at instances like you’re asking us to have her pilloried in entrance of the court for making use of language that most of us would uncover unacceptable.”

Justice Melissa Hart, even so, was extremely vital of Storey’s behavior in the Sullivan scenario.

“What motive,” she requested McConnell, “could an legal professional have for thinking, below our program, that undisclosed marital belongings could be applied to pay” a client’s costs?

More Stories

Moving at the Speed of Creativity

Balancing paid and organic search strategies for optimum success

A Great Way to Save Labour Cost