The Could final results are in, and products finance organizations seem to be dropping assurance in the calendar year in advance.

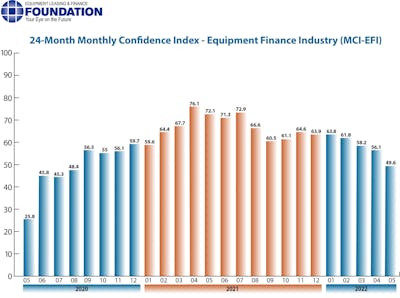

The Tools Leasing & Finance Foundation’s Could 2022 Regular monthly Self-assurance Index is now at 49.6, a 6.5-point minimize from the April index of 56.1, and a staggering 22.5-level fall compared to the similar period last yr.

When requested about the outlook for the long term, MCI-EFI survey respondent David Normandin, president and CEO of Wintrust Specialty Finance, mentioned, “Adapting to change is what the devices leasing field is all about. Our present-day mounting-amount setting will be great for the overall fiscal overall health of products finance businesses as obligors adapt to the new planet level get and margin is built again into the company. I do believe this will make problems for a lot of who may possibly not have a extended-expression secure money structure.”

Confidence in the tools finance current market is 49.6 for Might 2022, a reduce from the April index of 56.1.Tools Leasing and Finance Association

Confidence in the tools finance current market is 49.6 for Might 2022, a reduce from the April index of 56.1.Tools Leasing and Finance Association

- 6.9% of executives responding mentioned they believe organization situations will increase, down 14.8% from April.

- 10.3% of the study respondents believe demand for leases and loans to fund funds expenses will increase, down from 29.6% in the earlier thirty day period.

- 13.8% of the respondents be expecting extra accessibility to cash to fund gear acquisitions, down from 22.2% in April.

- 48.3% of the executives report they be expecting to employ additional staff, up from 40.7% in the former month.

- 3.5% of the management evaluate the current U.S. economy as “excellent,” down 14.8% from April.

Last but not least, 69% of respondents think financial circumstances in the U.S. will worsen in excess of the following six months, an increase from 40.7% in the earlier thirty day period.

Divided by sector segments, respondents were as follows: financial institutions, 58.6% captive finance, 13.8% and impartial finance companies, 27.6%

The index is a qualitative evaluation of vital machines finance sector executives on each prevailing business enterprise circumstances and long term anticipations, in accordance to the foundation.

More Stories

Wix Evaluate 2020

Make All Your Insurance Straightforward

Purchase Excessive Quality Backlinks